35+ transunion or equifax for mortgage

Both FICO and VantageScore assign higher credit. As mentioned there are.

Credit Scores Page 2 Of 3 Finmasters

Check All 3 Scores In 90 Seconds Or Less.

. Web Equifax et TransUnion calculent chacun votre pointage de crédit de manière légèrement différente. Web TransUnion can help you avoid unwanted setbacks by providing you with mortgage information on credit scores fees and more as you move to close the deal. See Score Factors That Show Whats Positively Or Negatively Impacting Your Credit Score.

Monitor Your Experian Credit Report Get Alerts. Ad Dedicated to helping retirees maintain their financial well-being. Pinpoint whats most affecting your scores.

Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Web Mortgage lenders tend to use all three of your scores from Experian TransUnion and Equifax to evaluate you for a home loan. Ad 90 Of Top Lenders Use FICO Scores.

Web In Canada TransUnion and Equifax are the two bureaus that lenders use to check your credit score and credit report which allows them to determine whether to. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Keep Your Credit Safe Protect Your Finances.

Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. Web Here are the FICO scores used in credit reports generated by the three credit bureaus as well as the alternative names the bureaus use to advertise them. Web Whats the Difference Between TransUnion and Equifax.

Web As mentioned above TransUnion and Equifax are part of the big three credit reporting agencies Experian being the third. Web Both credit bureaus prioritize payment history first with Equifax stating it makes up about 35 of the total score. Equifax showdown the latter considers your credit score status as excellent when you get to the 800 mark while.

Web FICO Score 5 is a scoring model that is commonly used by lenders in the mortgage and auto loan business. Web For instance when applying for a mortgage Bank A may look at TransUnion whereas Bank B may look at Equifax. As a result TransUnion reports.

Web TransUnion tends to use more sophisticated analytics and tends to offer more types of credit reports for consumers lenders and businesses. One of the most evident differences between these two bureaus is that Equifax scores range from 280 to. Web VantageScore is the result of a collaboration between the three nationwide credit bureaus Equifax Experian and TransUnion.

Dont Leave It Up To Karma. They also both consider your credit utilization ratio to be the 2nd. Web Equifax recommends aiming for a score of 739 or higher if a good score is desired.

Web When it comes to the TransUnion vs. The Equifax credit score model falls on a credit rating scale that starts at 280. Web Equifax Mortgage and Housing Services for Business Business Mortgage Housing Mortgage and Housing Drive better lending or rental decisions and enable a simplified.

Ultimately they offer the same. Ad View Your New 2023 Credit Scores Report. Your FICO 5 score is based on the information in.

Take out the guesswork with credit. See if you qualify. Ad Access to all 3 Credit Scores now is more important than ever.

What if your Equifax score is. Si vous avez déjà vérifié votre propre pointage de crédit et comparé les.

Which Credit Report Is More Important Equifax Experian Or Transunion

Which Credit Report Is More Important Equifax Experian Or Transunion

Transunion Vs Equifax Why Is There A Difference In Your Credit Scores

Ginyn8gyymlizm

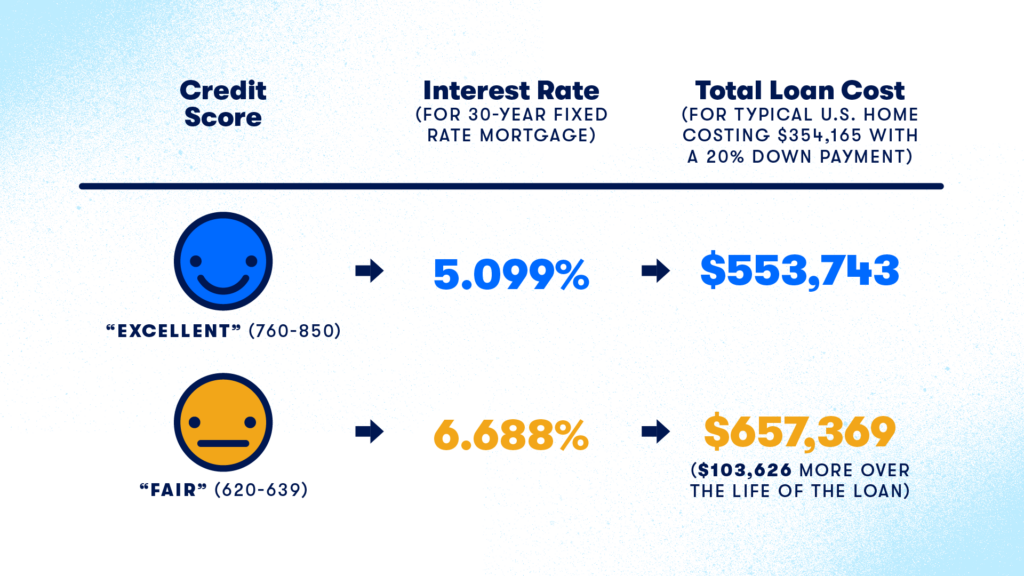

Do These Four Things To Qualify For The Best Possible Mortgage Interest Rate Zillow Group

746 By Korean Real Estate Weekly Issuu

What Credit Score Do You Need For A Mortgage Fox Business

Which Credit Score Model Is Used For Mortgage Loans Help Me Build Credit

C9slls0rc Zxbm

Sponsors Experience 2023

Transunion Vs Equifax What S The Difference Fortunly

Does Hacking Into The Fico System To Obtain A Perfect 850 Score Really Work Has Anyone Tried It Quora

Rent A Property Tips To Help If You Re Renting Mse

5 Helpful Tips For Refinancing A Mortgage With A Bad Credit Score Total Mortgage

Which Fico Score Do Mortgage Lenders Use Credit Strong

October 5th 2018 By Punjabi Patrika Media Ltd Issuu

What Credit Score Is Needed To Buy A House